Important Update: We are no longer accepting cases related to the Paycheck Protection Program. However, this page remains available for informational purposes. If you’re in need of legal assistance with another financial services matter, please visit our cases page for active investigations.

Minority-Owned Businesses Paycheck Protection Program Access: What You Need to Know

Many minority-owned businesses have struggled to gain access to designated CARES Act relief funds, including the Paycheck Protection Program. While McCune Law Group is no longer accepting new cases related to this matter, we’re dedicated to assisting affected business owners in our community. This page remains active as an informational resource for businesses who have been unable to receive much-needed economic assistance.

Understanding the Paycheck Protection Program (PPP) and Access Issues

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed in response to the economic downturn and devastation to small and mid-sized businesses caused by the COVID-19 pandemic. Passed in two parts, it allocated $649 billion to assist these businesses in keeping their workers employed. The PPP provides federally guaranteed loans of up to $10 million to small businesses, 100% of which may be forgiven if the borrower retains its employees on the payroll.

Although the CARES Act called for financial institutions to prioritize underserved businesses, minority-owned businesses have been struggling to gain access to necessary PPP relief funds.

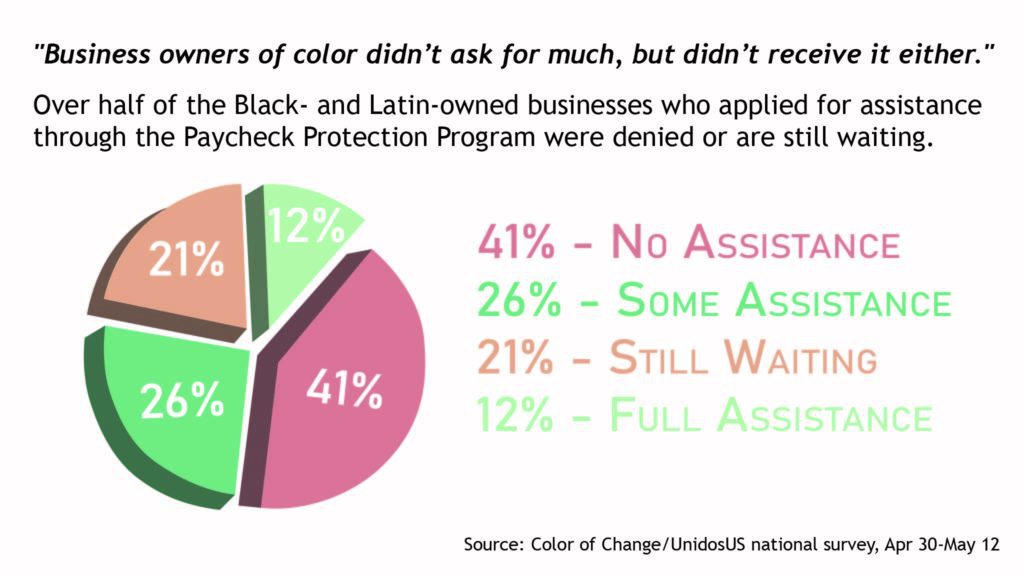

According to a 2021 survey of 500 Black- and Latin-owned businesses, conducted by Global Strategy Group for Color of Change and UnidosUS, almost half of minority business owners say their businesses may not have the funds to survive, and anticipate closing within six months. Although 51% of Black and Latino small business owners seeking PPP assistance requested less than $20,000 in temporary funding, only 12% (1 in 10) received the requested funding. 41% have received no assistance and 21% are still waiting to hear back on whether they will receive any assistance.

“[T]he Small Business Administration’s Paycheck Protection Program is a driver of racial inequality, rather than a means to provide desperately needed relief for the small businesses at the heart of Black and Brown communities,” said Color of Change President Rashad Robinson.

Who Has Been Affected?

While the vast majority of underserved and minority-owned businesses have been unable to obtain PPP funding, banks distributing PPP loans are prioritizing their wealthiest clients. According to the Center for Responsible Lending, minority-owned businesses are more likely to be disadvantaged by the manner in which banks lend PPP funds, such as:

- Minority-owned businesses likely have fewer employees and less revenue, making them less attractive borrowers.

- Minority-owned businesses are more likely to have no employees, unlike larger businesses which could garner higher fees.

- The Small Businesses Administration failed to issue guidance to lenders about prioritizing underserved markets, and rural, minority and women-owned businesses

- The PPP excludes people with criminal records, including people who have been charged, but not tried or convicted of a crime.

These barriers, alongside the banks’ prioritization of larger businesses and the fear that these loans will not be forgiven, may have caused many minority-owned businesses to forgo applications for PPP loans.

What Can Impacted Minority-Owned Businesses Do?

- Explore Pre-existing and Ongoing Class Action Suits: Several PPP loan lawsuits have been filed across a number of states. For further information on these, you can explore the list of active class action suits on Expert Institute’s Paycheck Protection Program (PPP) Class Action Litigation Guide.

- Contact the Small Business Administration: The SBA is a government entity that offers counsel and other resources to small business owners. They may be able to offer support to business owners struggling to access relief funds.

- Seek Further Legal Guidance: If you’ve experienced issues accessing necessary business funds or have been affected by another financial services matter, you may still qualify for legal action. Explore our Financial Services cases for more details.

Related Cases and Legal Areas

Though we’re not currently taking cases related to Paycheck Protection Program loans, we may be able to assist you with a similar matter. We recommend exploring the following practice areas:

- Financial Services: Concerns related to borrowing, lending, or otherwise transacting are best addressed by a financial services attorney.

- Commercial Litigation: Business owners looking for legal strategies pertaining to anti-trust violations fraud, breach of fiduciary duty and other matters may be best served by an attorney specializing in commercial law.

- Class Action: When multiple parties have been harmed by the same issue, they may form a class to pursue justice as a collective.

Require Further Assistance?

If you’re a small- to mid-sized business owner being impacted by a financial services or commercial litigation issue, our experienced attorneys are here to help. Contact our financial services or commercial litigation teams to explore your legal options.

You can reach us today at (909) 345-8110 or fill out our online form.

Final Note

This page is no longer accepting new cases related to Paycheck Protection Program matters. It remains active as a resource for affected business owners.

Attorney Advertising

McCune Law Group, APC is responsible for this advertisement. The information provided on this website is for general information purposes only. The information you obtain is not, nor is it intended to be, legal advice. Use of this website or submission of the online form does not create an attorney-client relationship.

Counsel Richard McCune is licensed to practice only in the state of California. The law firm of McCune Law Group has attorneys licensed to practice law in AZ, CA, IL, MO, NJ, NY, and PA. This information section is not intended to be a solicitation for services in states where it is forbidden for non-barred attorneys from advertising for services, and McCune Law Group does not have attorneys barred in that state. McCune Law Group is a national firm that brings lawsuits in a majority of the states. In states where one of its attorneys are not barred, it does so by filing the complaint along with local counsel barred in that state.

The results discussed do not guarantee, warrant, or predict the results in future cases.